Wire Transfer from India – Complete Guide to Sending Money Abroad

Sending money overseas is a common need for students, families, and professionals. A wire transfer from India is one of the most reliable ways to send funds to a foreign bank account. Unlike traditional methods that once required physically transporting cash, today’s wire transfers happen electronically through secure banking networks.

In this article, we explain how international wire transfer from India works, the process involved, the costs, and important compliance requirements.

What Is a Wire Transfer?

A Wire transfer is a method of electronically moving money between banks across countries. Instead of transporting cash, banks send secure electronic instructions to credit the recipient’s account.

This system, regulated by the Reserve Bank of India (RBI), is among the most widely used methods for sending money abroad from India. Whether you’re paying tuition fees, supporting family, or transferring funds for medical needs, wire transfers remain one of the safest choices.

Why Use Wire Transfers for Sending Money Abroad?

Wire transfers are favored for their speed, global acceptance, and security. Here’s why they are often preferred over other methods:

- Global reach: Wire transfers connect Indian banks with thousands of international banks worldwide.

- RBI-approved: Every transaction follows strict Indian regulations under the Liberalised Remittance Scheme (LRS).

- Transparency: Exchange rates and charges are disclosed upfront.

- Security: Transfers are routed via the SWIFT network, considered one of the safest global payment systems.

The Wire Transfer Process Explained

The process for international money transfer from India follows a step-by-step sequence. Below is a simplified overview.

1. Selecting a Bank or Authorized Service Provider

To start, the sender chooses between an Indian bank (such as SBI, HDFC, ICICI, or Axis Bank) or an RBI-authorized money changer like Savi Forex. Both can facilitate outward remittances, but authorized forex providers often offer more competitive exchange rates and quicker service.

2. Completing KYC Documentation

Before transferring, the sender must complete Know Your Customer (KYC) checks. This ensures compliance with RBI guidelines and confirms that the annual remittance limit of USD 250,000 under LRS is not exceeded.

Common KYC documents include:

1. PAN Card

2. Form A2 (with beneficiary details)

3. A valid government ID (Aadhaar, Passport, or Driving License)

3. Funding the Transfer

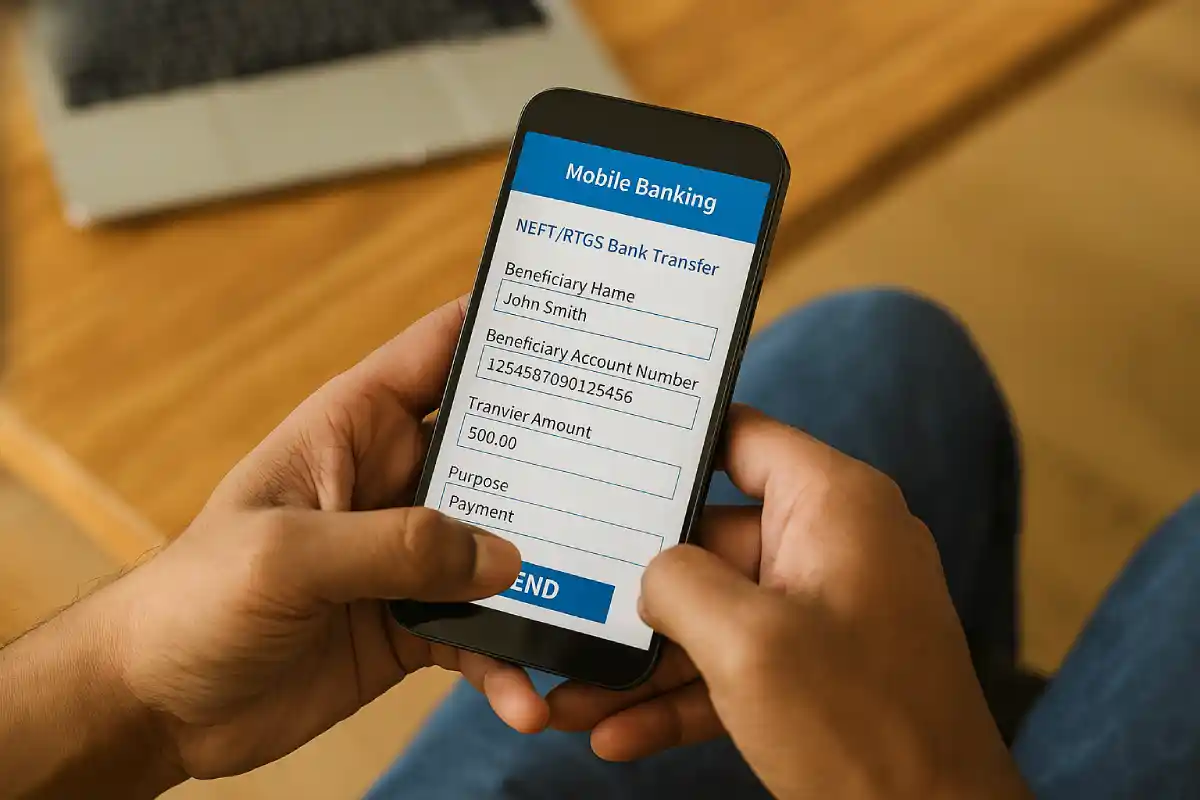

Once KYC is verified, the sender transfers funds to the chosen service provider through NEFT or RTGS. The amount includes the transfer value plus applicable charges and taxes.

Typical fees include:

1. Transaction fee – charged by the bank or money changer.

2. GST – applied on the service fee.

3. Intermediary bank fee – sometimes charged if the receiving bank has no direct relationship with the sender’s bank (up to USD 25).

4. Processing via SWIFT Network

The provider books the exchange rate and initiates the transfer using the SWIFT system (Society for Worldwide Interbank Financial Telecommunication).

If the sending and receiving banks are directly connected, funds move faster.

If not, intermediary banks help route the message, which may take extra time.

On average, wire transfers take from a few hours to two business days to complete.

5. Credit to Beneficiary’s Account

Finally, the recipient’s bank receives the SWIFT message, verifies details, and credits the funds into the beneficiary’s account. At no stage does physical money move only secure electronic instructions.

How Long Does an International Wire Transfer from India Take?

Most wire transfers are credited within 24–48 working hours. However, timelines vary depending on:

- Time of initiation (transfers after banking hours may get processed the next day).

- Direct or indirect SWIFT connections between banks.

Compliance checks for large or first-time transactions.

Key RBI Guidelines for Sending Money Abroad

The Reserve Bank of India regulates outward remittances to ensure transparency and prevent misuse. Under the Liberalised Remittance Scheme (LRS):

- Residents of India can remit up to USD 250,000 per financial year.

- Funds can be sent for approved purposes such as education, travel, family maintenance, medical expenses, and investments.

- Each transaction requires submission of Form A2 along with KYC documents.

Violating these rules can lead to delays or rejection of your transfer, so compliance is critical.

Costs Involved in Wire Transfers

Understanding charges upfront helps avoid surprises. Costs usually include:

- Exchange rate margin – difference between interbank rate and provider’s rate.

- Service fee – flat or percentage-based charge for processing.

- Intermediary bank fees – if applicable.

- Government taxes – GST on service fees.

Working with a specialized forex partner like Savi Forex often reduces costs since they offer competitive exchange rates compared to many banks.

Tips for a Smooth Wire Transfer from India

To make your transfer seamless, keep these points in mind:

- Double-check beneficiary details (account number, bank code, and name).

- Initiate transfers during banking hours for faster processing.

- Compare exchange rates between banks and forex providers.

- Keep proof of transfer and SWIFT reference number for tracking.

Alternatives to Wire Transfer

While wire transfer remains the most secure and regulated option, other methods exist for sending money abroad from India:

- Foreign currency demand drafts – slower but useful in specific cases.

- Online money transfer apps – convenient but often with higher fees or limits.

- Forex cards – suitable for students or travelers needing easy access to funds.

Still, for larger amounts or official purposes, wire transfer continues to be the preferred choice.

Why Choose Savi Forex for International Wire Transfers?

At Savi Forex, we specialize in outward remittances and ensure that your transfer is handled with speed, accuracy, and compliance. With us, you benefit from:

- Competitive exchange rates.

- Fast processing via SWIFT.

- Step-by-step guidance on documentation.

- Transparent charges with no hidden costs.

Whether it’s tuition payments, family support, medical expenses, or managing travel with a forex card, we simplify the process of international wire transfer from India.

Conclusion

Wire transfers remain the safest, RBI-approved way of sending money abroad from India. With the right partner, the process is simple, transparent, and cost-effective.

Looking to send money overseas quickly and securely? Contact Savi Forex today for expert assistance with your international wire transfer from India.