Ultimate Guide to Currency Exchange in India: For Beginners

If you are traveling abroad, studying overseas, or running an international business, understanding currency exchange in India is essential. This guide explains how currency exchange in India works, where to convert money, the documents required for currency exchange in India, and practical tips to get better rates and avoid surprises.

Currency Exchange in India: A Quick Overview

This section provides a concise overview of the process and objectives of currency exchange in India, enabling beginners to plan with confidence. You’ll learn where to go, what to carry, and how to compare offers for currency exchange in India.

Currency exchange in India means converting foreign cash or digital funds into Indian rupees and vice versa. Beginners searching for currency exchange in India need clear steps, safe providers, and answers about RBI guidelines for currency exchange. When you plan for any transaction, check fees and rates before you exchange to ensure your currency exchange in India transaction is cost‑effective.

Where to exchange foreign currency in India

Learn the main places to exchange currency, and what each option offers for speed, cost, and convenience.

Banks, airport counters, licensed money changers, and online platforms all provide foreign currency exchange. Many travelers ask where to exchange foreign currency in India and which option gives the best currency exchange rates in India. Banks are secure but may require paperwork; airports are convenient but usually charge higher margins; authorized money changers and online services often offer competitive rates for currency exchange in India.

If you’re exchanging in Bangalore, see our detailed post on How to Exchange Foreign Currency to Indian Rupees in Bangalore.

Documents required and the currency exchange process in India

Know the documents you must carry and the typical step‑by‑step process when you visit an authorized provider.

To complete a currency exchange in India, carry a valid passport or government ID and be ready to show proof of travel. For larger exchanges, providers will ask for a PAN card and additional proof of residence. The currency exchange process in India usually follows these steps: choose an RBI‑authorized provider, compare rates, present documents, complete the exchange (cash, card, or transfer), and keep the receipt.

How to find the best currency exchange in India

Practical checks to spot fair providers and how to compare effective rates for your needs.

Look beyond the headline rate when evaluating the best currency exchange in India. Confirm whether the quoted price includes commission, service fees, or delivery charges. Read recent customer reviews and verify RBI authorization to avoid unlicensed operators. If you live in a major city, the best currency exchange providers in India often run online booking, home delivery, and quick support for queries.

Hidden fees are common. Read our detailed guide on What is Forex Markup? Guide to Currency Exchange Fees to understand extra charges.

Tips for exchange services in India for beginners

Quick, beginner‑friendly tactics to save money and reduce hassle while exchanging currency.

- Track live exchange quotes before converting to lock in a favorable currency exchange rate in India.

- Avoid last‑minute airport exchanges. Airport counters typically give less favorable currency exchange rates in India.

- Compare banks, licensed money changers, and online providers to find the most competitive currency exchange option in India.

- Prefer authorized dealers and keep all receipts to meet RBI requirements.

Currency values shift daily learn How Currency Fluctuations Affect Currency Exchange Rates to plan better.

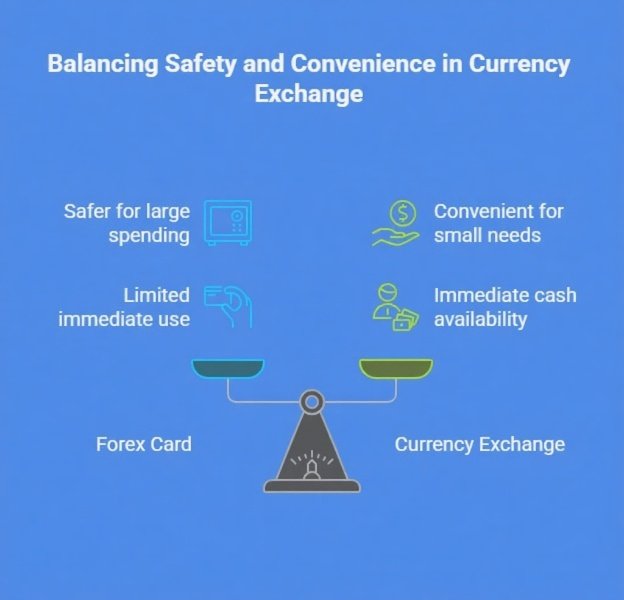

Difference between a forex card and currency exchange in India

When to use a forex card versus when to carry cash converted at a currency exchange in India.

A forex card is a prepaid travel card loaded with foreign currency and is generally safer for larger spending abroad. For immediate cash needs, such as taxis, tips, or small purchases, consider using a currency exchange in India provider to obtain local currency. Combining a forex card with some cash obtained through currency exchange in India often provides the best balance of safety and convenience.

Safe and legal exchange services in India

How to keep your money secure and meet legal requirements when you exchange currency.

Always use RBI‑approved providers for currency exchange in India. Follow RBI guidelines for currency exchange, carry required documents, and reject offers from unlicensed or street vendors. If you choose banks or licensed money changers, they will log the transaction and issue receipts—protecting you and ensuring that your currency exchange in India transaction is legal and traceable.

Currency exchange in Bangalore and other cities

Local differences and services to expect in major Indian cities such as Bangalore, Mumbai, and Delhi.

Cities with international travel hubs and large student populations, like Bangalore, offer many competitive currency exchange services in India with online booking and home delivery. Local demand often means more competitive pricing; still, compare quotes and verify the provider’s license before completing a currency exchange in India transaction.

How to get the Best Forex Rates in India

Tactics and timing to secure a better rate on your foreign currency purchases.

Monitor live rates and use rate‑locking features offered by many online platforms to secure a favorable currency exchange in India. For business transfers, consider forward contracts or rate alerts through a trusted partner. Large exchanges benefit from negotiation. Ask your provider about volume discounts on currency exchange in India.

For Students and Long‑Term Visitors

Student‑focused guidance on budgeting, payments, and safe forex options for study abroad.

Students should arrange most of their major payments, tuition, and housing through bank transfers or secure remittance services while handling daily expenses via a forex card and small cash from a currency exchange in India. Some providers offer student plans or reduced margins for recurring exchanges; check for special student offers with your chosen currency exchange in India partner.

For Businesses and Remittances

How businesses manage recurring forex needs and comply with RBI rules during inward and outward transfers.

Companies exchanging currency in India frequently use corporate forex accounts and work with authorized partners to schedule transfers, hedge risk, or set forward contracts. Trusted advisors help firms understand any RBI guidelines for currency exchange that affect export receipts, invoices, or foreign supplier payments.

Common Fees and Hidden Charges

Know the typical fees and how to request a clear, itemized cost breakdown before you proceed.

Providers may add commissions, delivery charges, or non‑transparent margins. Ask for a written quote to see the net currency exchange rate in India after all fees. Comparing the net rate, not just the headline price, lets you choose the real best deal for your needs.

A Practical Pre‑Exchange Checklist

A short, printable checklist to prepare before you walk into an exchange counter or confirm an online order.

- Confirm the total cost and the net currency exchange rate in India after fees.

- Have a passport, a visa, and a PAN card ready for larger transactions.

- Compare at least three providers before you commit.

- Use a mix of a forex card and cash for safe travel.

FAQs

How much cash should I carry abroad?

Keep enough for the first 48–72 hours and rely on a forex card for larger spending. Visit a trusted currency exchange in India to convert cash before travel.

Can I exchange large sums?

Yes, but expect PAN and additional verification for large currency exchange transactions in India.

Are online platforms safer for Currency Exchange?

Reputable online platforms can offer better rates and tracking; verify authorization and reviews before you rely on any website for currency exchange in India.

Closing Tips: Make Currency Work for You

Small habits that deliver long‑term savings and safer transactions for repeat exchangers.

Use rate alerts, build a relationship with a reliable provider, and check RBI notifications that affect currency exchange in India. Keeping simple records and receipts helps you track costs and ensures a smooth compliance trail for all currency exchange transactions in India.

Ready for expert help? Contact Savi Forex and Tours Pvt Ltd for personalized advice, real‑time rate alerts, and secure currency exchange in India services for travelers, students, and businesses. We guide you through the currency exchange process in India and help you choose the best option for your situation.