Understanding Currency Exchange Rates: A Comprehensive Guide

Currency exchange rates are something everyone needs to understand, especially if you travel abroad or do business internationally. These rates tell you how much one currency is worth when you exchange it for another. For travelers, exchange rates affect how much they can spend in a foreign country. Businesses’ costs and profits when dealing with international clients are impacted. In this guide, we’ll break down the basics of currency exchange rates, their effects, and how you can make smart decisions to get the best currency exchange in Bangalore.

What Are Currency Exchange Rates?

Currency exchange rates are simply the price of one currency compared to another. For example, if you’re traveling from India to the US, the exchange rate tells you how many Indian Rupees you need to get one US Dollar.

There are two main types of exchange rates:

- Floating Exchange Rate: This type of rate changes all the time. It depends on the supply and demand for currencies in the market. If a lot of people want to buy US Dollars, for instance, their value will go up.

- Fixed Exchange Rate: Some countries decide to keep their currency value steady by tying it to another currency, like the US Dollar. This means the exchange rate doesn’t change much over time.

Factors Influencing Exchange Rates

A lot of things can change the value of a currency. Let’s look at some of the key factors:

- Economic Indicators: Things like inflation (how much prices rise over time), interest rates (how much banks charge to lend money), and the country’s overall economy all play a role. For example, if India has high inflation, the Rupee may lose value compared to the Dollar. On the other hand, if interest rates go up, it can attract investors, and the currency might become stronger.

- Political Stability and Economic Performance: A country with a stable government and a strong economy will usually have a stronger currency. Investors want to put their money in safe places, so they’ll buy more of that currency. But if a country has political problems or a weak economy, its currency may lose value.

- Supply and Demand: Just like anything else, when more people want a currency, its value goes up. When fewer people want it, its value goes down. For example, if India’s exports increase, more people will need Rupees to buy Indian products, which could increase their value.

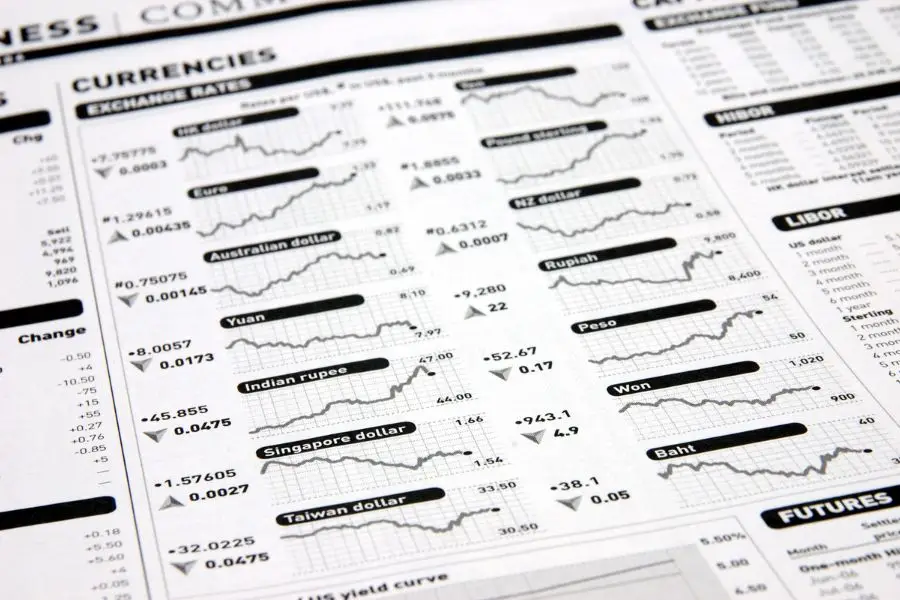

How to Monitor Exchange Rates

Staying updated on currency exchange rates can help you save money, especially if you’re traveling or doing business internationally. Here’s how to easily track exchange rates:

- Websites: There are many websites like Savi forex and other trusted websites that show live currency exchange rates. You can check them to see how rates are changing over time.

- Mobile Apps: Apps like Revolut or TransferWise can make it easy to monitor rates from your phone. These apps let you convert currencies, track rates, and some even let you hold multiple currencies.

- Set Alerts: Many apps and websites allow you to set up notifications. For example, you can get an alert when the exchange rate reaches a certain level, so you know when it’s a good time to exchange your money.

Practical Tips for Currency Exchange

When you exchange currency, it’s important to get the best rate possible. Here are a few simple tips to keep in mind:

- Best Times to Exchange: Currency exchange rates often change during different times of the year. For example, during popular travel seasons or around major economic events, rates can fluctuate. If you’re planning a trip, try to exchange your money when the rates are more favorable.

- Minimize Fees: One of the most important things to remember is to avoid high fees. Currency exchange services at airports often charge higher fees and offer lower rates. For the best currency exchange, look for providers who are upfront about their fees and offer better rates. Compare a few services before making your choice.

- Avoid Last-Minute Exchanges: Plan when you need to exchange money. If you wait until the last minute, like at the airport or in a rush, you may end up paying a higher rate.

Conclusion

In conclusion, understanding currency exchange rates is crucial whether you’re traveling or managing international business. By keeping an eye on what drives these rates, using the right tools, and following smart strategies, you can save money and get the best deal. And if you’re in Bangalore, don’t forget to look for the best currency exchange services that offer competitive rates and low fees.

Staying informed will always help you make the best decisions when it comes to exchanging currency!